WellDatabase + Funk Futures

We’re excited to start working with the team at Funk Futures. We believe our software gives the industry the better data option it deservers with...

You need data. You need mapping. You need tools to analyze that data. Now you can do everything in a single, easy to use platform.

Perfect for users who need access to basic well level data. If you're only interested in a few wells and currently use state sites, this plan is for you.

The industry didn't start with unconventionals and neither does our data. We cover the full historical dataset across every producing state and province. Don't settle for inferior data, check out our coverage for any state or province you're interested in.

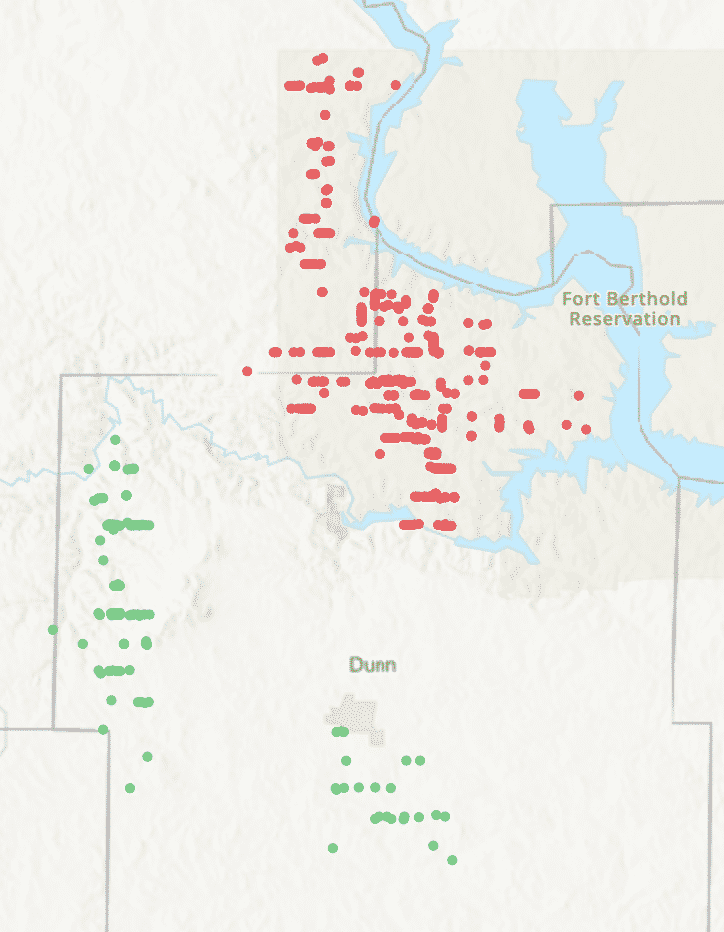

Many have called for M&A for years, and 2020 saw a good amount to aid in consolidation of the industry. It has been busier as of late with $3.4 billion in Q1 of 2021 vs $600 million in 2020. The latest was Enerplus acquiring the Little Knife and Murphy Creek acreage from Hess – 78,700 acres to be exact. The question is, how does this fit into their respective strategies and what exactly is Enerplus getting?

Enerplus has doubled down in the Bakken with this deal and the acquisition of Bruin last month. Combined they’ve added 229,700 acres for $786m. It should give them close to a decade worth of development runway. This move fits with their strategy in the Bakken and is well positioned vs their existing acreage. It may be overpriced compared to other deals, but they may see this as meat left on the bone by Hess that they can make the most of.

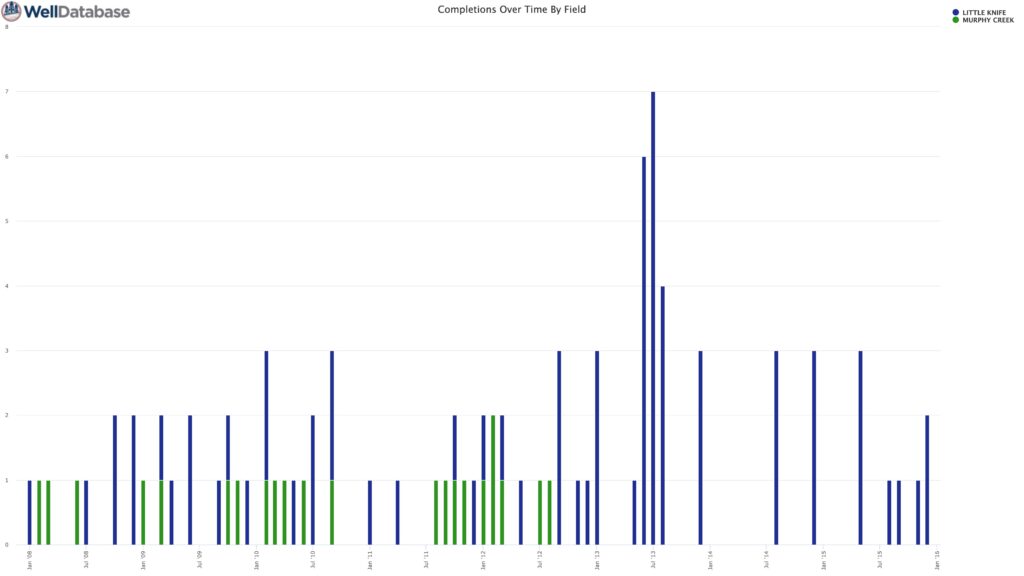

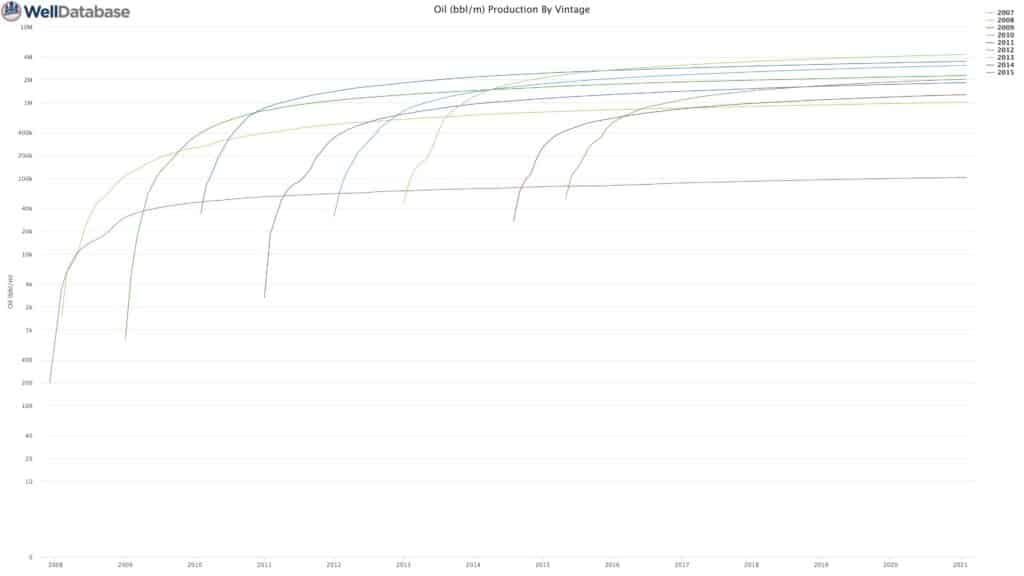

Hess hasn’t completed a well here in 5 years (completion records below). But they have still been producing. Over time the production seemed to get better, potentially as designs improved.

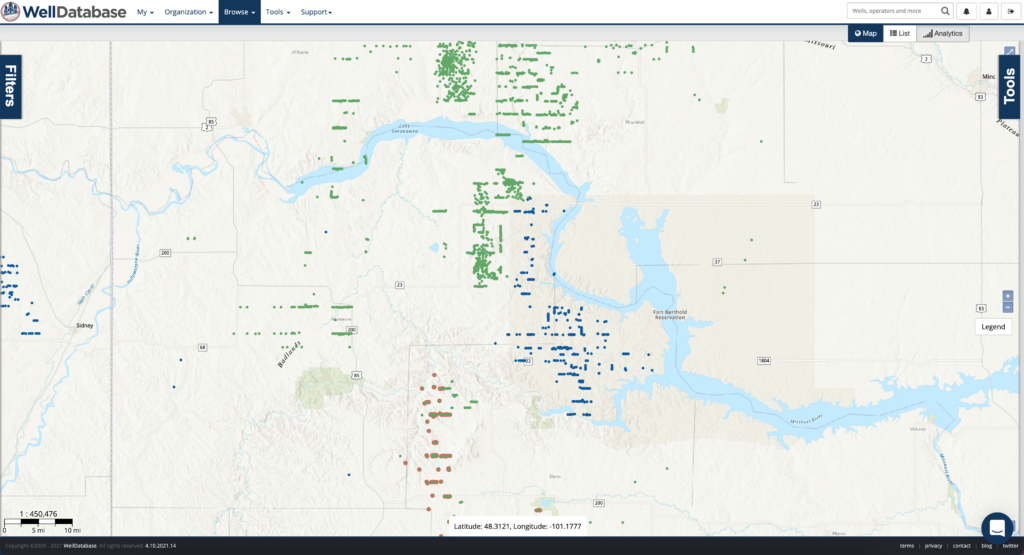

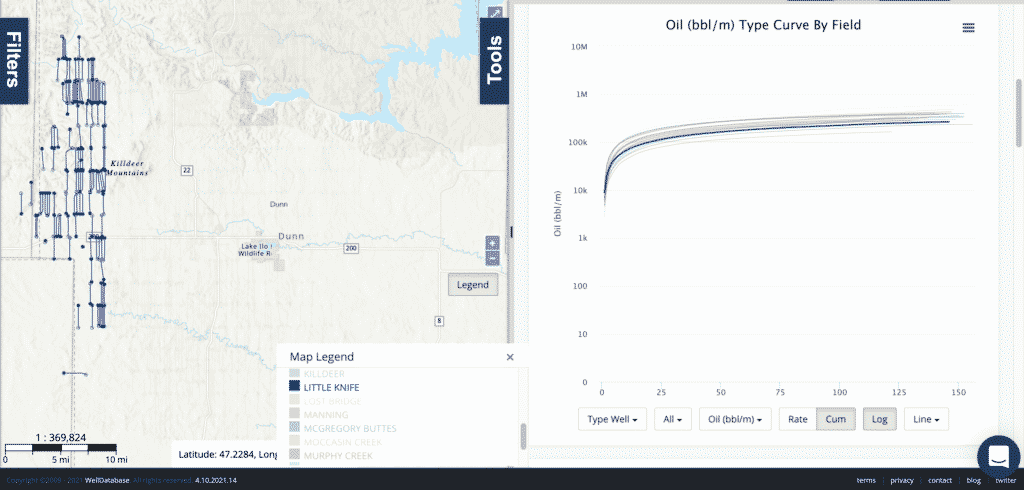

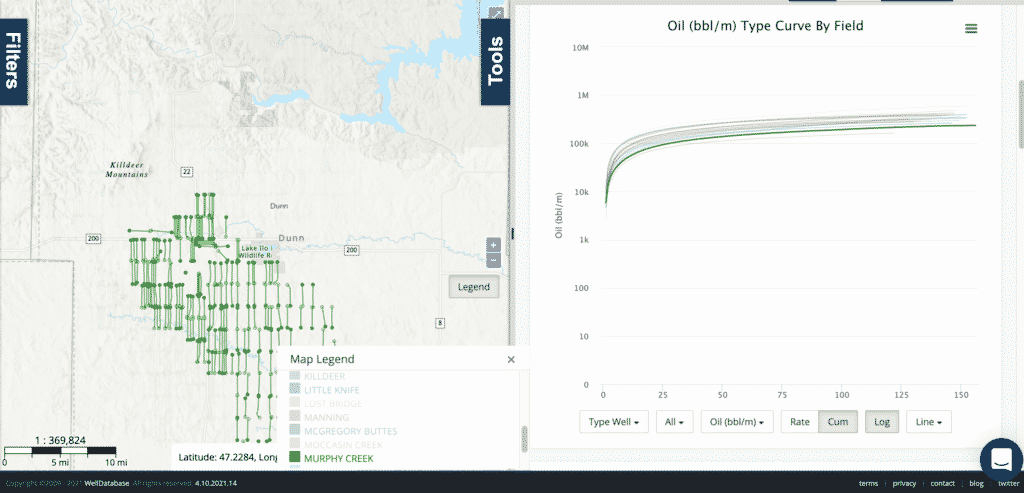

However, these fields are very far from their core acreage (seen below) and performed below most other fields (also seen below). So was it Hess getting out with a solid offer in hand?

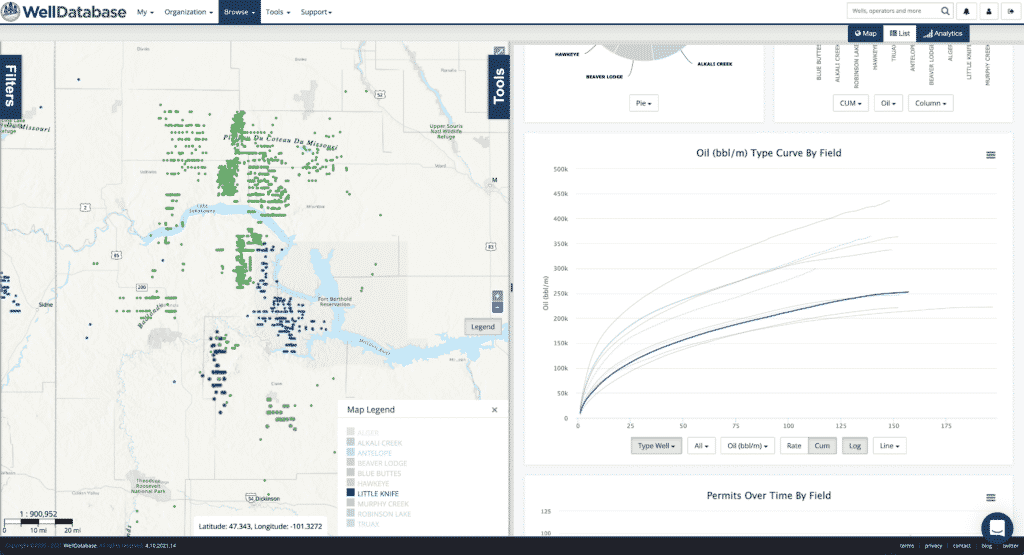

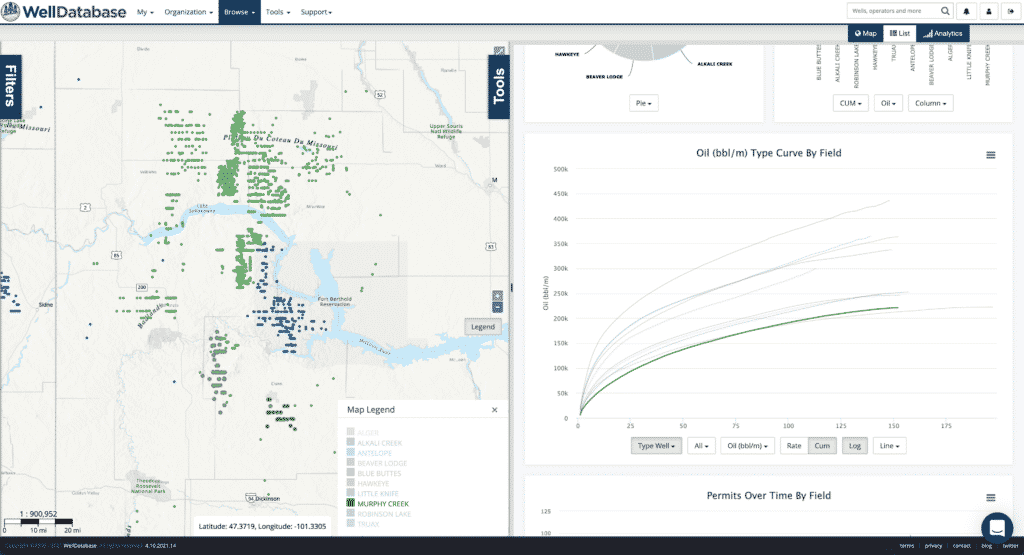

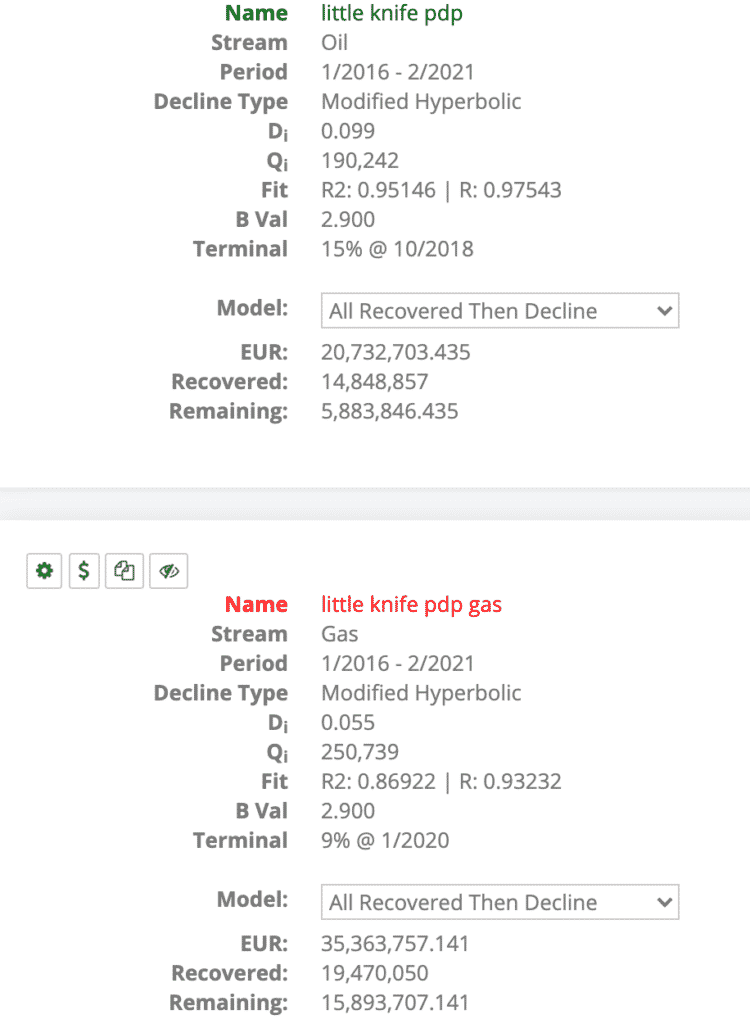

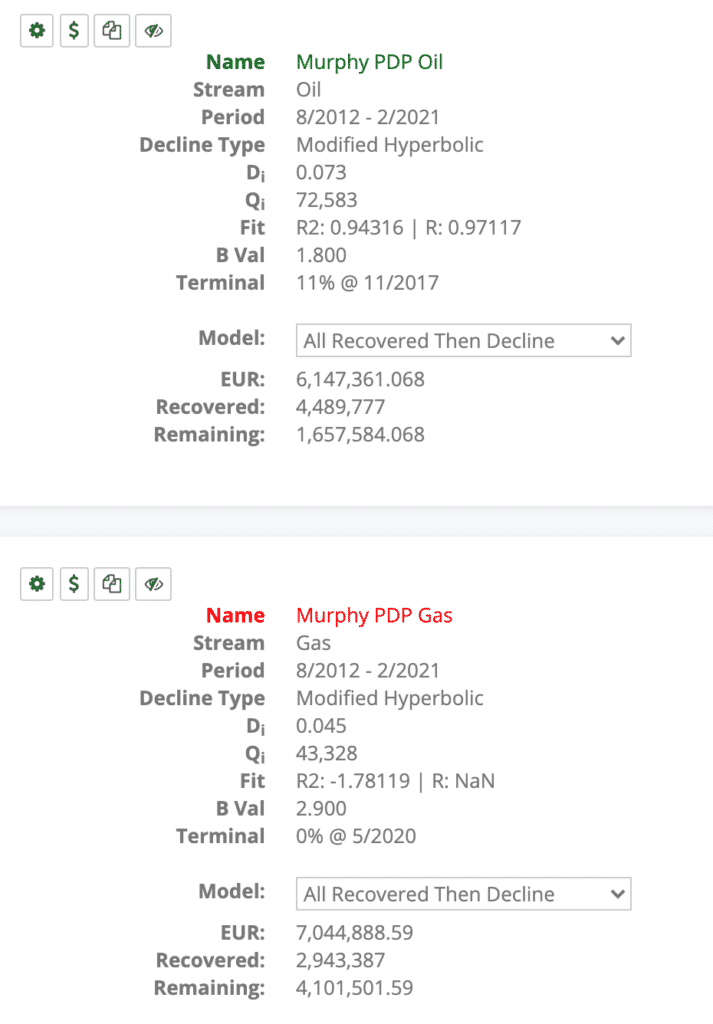

I wanted to give a snapshot of the PDP for each field. Using WellDatabase makes it quick to search and filter down to these fields. Then, using our Production analytics you can run an exercise on the total wells. Traditionally you may look at each well individually, but since no new wells have come online recently we can take a high level look at all the wells and their production.

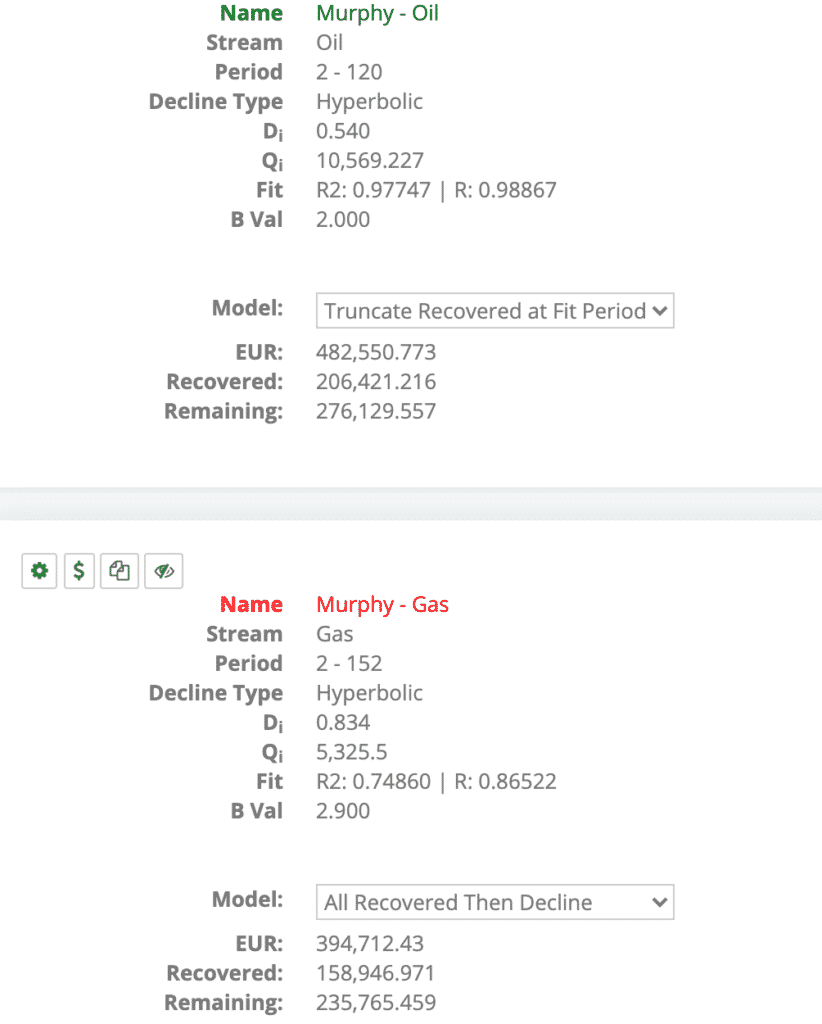

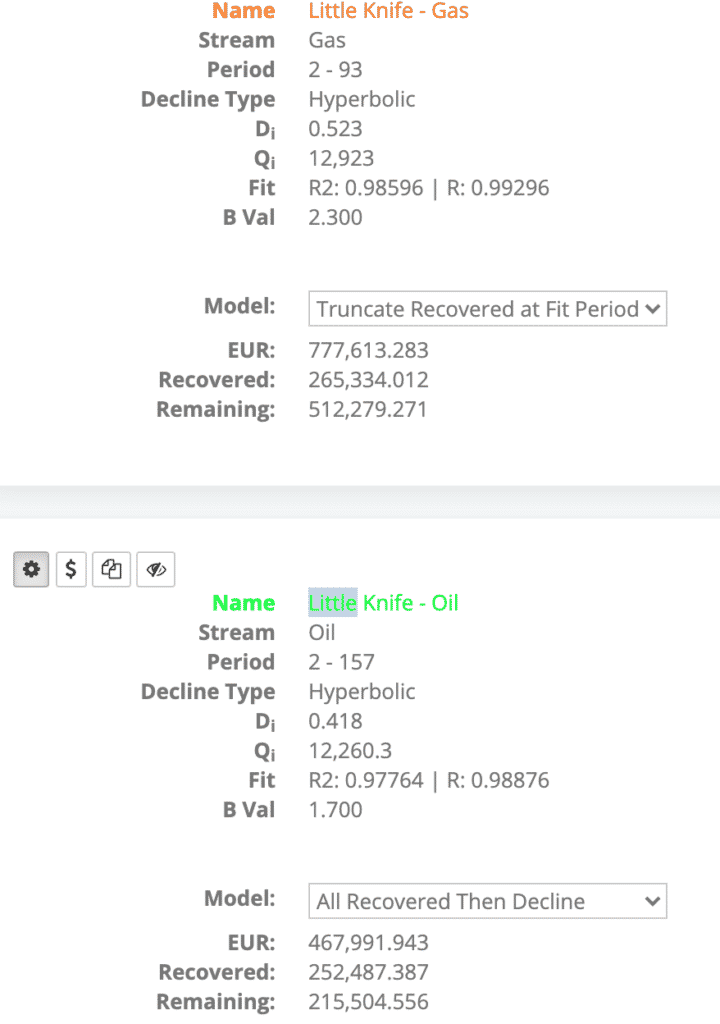

We’re also able to do some forecasting with decline curves on the existing wells in these fields using our Type Curve tools. Selecting half of the total well count and using a hyperbolic decline gives the below results. All this together, and with the corresponding data exported from WellDatabase, gives a picture of the hope Enerplus has as they continue development.

Comparing the type curves to those of other fields in the nearby area from the same timeline (completions 2008-2016), the Little Knife and Murphy Creek fields actually appear to be in the middle of the pack to below average. It does give them 3 of the top producing fields in Dunn County as far as total production and well count, but on a well by well basis they aren’t at the top.

Hess has been disciplined in their development and some of the wells in these fields seemed to fair better over time. Unless there is a giant piece of information they don’t want anyone to know, the sale has the potential to make a good return on medium acreage towards the bottom of their portfolio. This enables them to focus on more important assets over the next 5-10 years instead of holding onto noncore assets.

Enerplus paid a premium, but this acquisition fits into their strategy. They’ll need to continue to trust their designs to bring them to above average production for the area. Although they used credit facilities to make it work, they still have $900m in facilities open and a plan in place to clear this debt quickly via cash flow estimating $1.2-1.8b over the next 4 years. This success is based on the assumption that oil stays over $50. They look to have ambitions of tripling daily mboe output, so responsible development of the 230+ un-drilled locations will be key for avoiding balance sheet demise and securing strong returns.

The biggest positive I see, since we can’t guarantee much, is that only 3% of this acreage is on federal land. This means minimal potential impact, which is a win in the current landscape. Only time will tell if they swung too hard for the fences or if they will be one of few remaining players dominating the Bakken.

Remember to come check out WellDatabase to try running all these scenarios yourself. It’s free to get started using well level data, and you can trial our plans to access the tools and analytics shown here.

We’re excited to start working with the team at Funk Futures. We believe our software gives the industry the better data option it deservers with...

WellDatabase is proud to announce a new partnership with Hunter Technology.

The team at OG Trust Services, LLC (“OGTS”) has relied on WellDatabase for years, but not we are proud to partner with them to integrate...